Upload your press release

The See-Saw Effect In Freight Rates Affecting Supply And Demand Equilibrium In Container Shipping

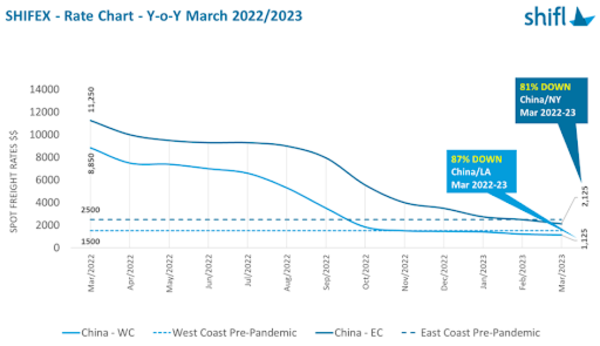

These reductions have pushed container spot rates below pre-pandemic levels, disappointing container shipping lines that have been bolstering their financial reserves since 2020 thanks to the huge surge in demand caused by COVID-19 pandemic, which now seems like a distant memory.

It is common knowledge that the emergence of COVID-19 in 2020 dramatically altered consumer behavior and the ocean freight market. This resulted in unparalleled demand shocks, disturbances, purported collusion among ocean carriers, variations in container volumes, and fluctuating freight rates. The ensuing market upheaval led to worldwide port congestion, which in turn caused soaring freight rates and extensive delays.

Fast forward to 2023, carriers and ports alike are concerned about the reduction in volumes in 2023. As per port information, the Port of New York and New Jersey experienced a drop of 17% in Jan 2023 compared to 2022 although the Jan 2023 volume was marginally higher by 0.41% than the pre-pandemic volume of Jan 2020.

The West Coast ports of Long Beach and Los Angeles have also suffered loss of volumes with Long Beach experiencing a 32% drop in volumes for the same period while Los Angeles had an almost 13% drop.

The volumes in Feb 2023 seems to have been much worse for the San Pedro ports with Long Beach experiencing a 37% drop and Los Angeles recording a 41% drop in import volumes compared to Feb 2022.

As the tsunami of high freight rates simmers and settles, questions are now being raised on what global trade patterns have in store for the industry and how the carriers and customers will handle this slippery slope.

“The global shipping industry has been facing significant volatility in recent years, and the current depressed ocean freight rate demand from Asia to the USA is no exception, something that has far-reaching consequences for both customers and shipping lines,” said Shabsie Levy, CEO of Shifl.

“The continuing global economic slowdown, overstocked inventories, shift in manufacturing from China to other regions like Southeast Asia, South Asia, and Africa is also leading to depressed cargo volumes resulting in reduced demand for shipping services ” added Levy.

Customers and carriers will suffer alike

Carriers are not the only ones that will be affected by lower rates and reduced demand. While the reduction in rates may appear to be a positive for customers, the reduced demand in volume can lead to an oversupply of shipping capacity which could lead to service disruptions and longer transit times.

As per Shifl’s data, longer transit times are already visible on the China/US routes with New York seeing a 17% increase in transit times in March 2023 compared to Dec 2022 while LA/Long Beach is showing a 6% increase for the same period, down from 17% in Feb 2023.

“We are seeing shipping lines opting for slow steaming and in some cases cancel sailings causing unpredictability in shipping schedules and making it challenging for our customers to plan their supply chain activities,” said Levy.

Some customers have also hinted at re-evaluating their volume commitments to carriers in the near future. As spot rates once again become a more attractive option for certain customers, they may take advantage of the current low-demand environment by comparing offerings from various carriers and selecting the one that aligns with their needs.

Low freight rates highlight the risk of some of the smaller shipping lines who entered the market to take advantage of the high freight rates previously, now reconsidering their options further lowering capacity in the market and opening themselves up to M&A by larger players reducing competition and potentially leading to higher rates in the long term.

With the larger shipping lines currently at their financial best, such M&A activities could become a reality.

Outlook and Recommendations

While there is uncertainty if container spot rates have reached their lowest point, indications are that the depressed ocean freight rate environment from Asia to the USA and Europe is likely to persist in the short to mid-term due to the above-mentioned trade tensions, economic uncertainty, and the continued impact of environmental regulations.

Container volume is expected to pick up slightly as we head to the peak season albeit not even close to the levels of the past 2 years. Shippers and carriers should both look to adapt and develop suitable strategies to mitigate the risks, capitalize on potential opportunities to navigate this challenging landscape and try to equate supply and demand.

About Shifl:

Shifl is bringing the supply chain into the future with technology and innovation that brings a huge array of real-life benefits to its customers. If you are an importer looking to bring your business into today’s digital age, be more in control of your shipping processes, and pay less — Shifl is for you. Shifl is headquartered in New York and maintains a presence in China, India, Vietnam, Malaysia, Bangladesh, Georgia, Dominican Republic and The Philippines. To learn more, visit https://shifl.com.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing