Three critical success capabilities

To survive in this volatile business environment, third-party logistics providers and their customers must work together to build up their digital capabilities and talents while also focusing on meeting the end customer’s needs.

Effectively matching supply and demand has always been challenging, but the current volatility in many supply chains has made it even harder, creating new and unique problems. Companies desperately need innovative and improved solutions to deal with supply chain complexity and create agility and responsiveness.

One key facilitator of success will be the ability of supply chain partners to be well-aligned and to optimize the capabilities of each partner within the network. Now in its 27th year, our “Annual Third-Party Logistics Study” has time and again shown the benefits of working with logistics service providers to navigate market uncertainties and achieve overall success for the supply chain.

High-level research results from this year’s study indicate three key focus areas for strengthening relationships between third-party logistics providers (3PLs) and their customers: 1) the ability to collaborate in the interest of creating value for customers and consumers, 2) the ability to create insight through digitization and analytics, and 3) the critical need for talent. (A broader and more detailed summary of the research will be presented at the CSCMP EDGE Conference in Nashville, Tennessee, on September 19.)

Creating value for the end customer

For 3PLs and shippers to have a successful relationship, both parties need to understand the overall supply chain goals and use this knowledge to create effective working relationships.

As the primary flows of products and services in supply chains are downstream toward the eventual consumers and business customers, the supply chain’s most important priorities should be related to satisfying demand and creating value for these parties.

Ideally, then, all participating supply chain organizations, including 3PLs, should have some understanding of demand patterns at the customer/consumer level that are driving requirements for the overall supply chain. One way to achieve this is by sharing available forecast and demand planning information relating to the needs of customers and consumers.

The best results are achieved when both 3PLs and their customers are working with accurate information and are well-aligned on goals, objectives, and working relationships. 3PLs and customers must also be aware of factors that may impact the ability of supply chains to meet these overall objectives. Partners should be willing to share information on potential problems and issues—these could range from a shortage of transportation capacity to unexpected volatility in the availability of needed materials and supplies.

Digitization and analytics

For many years, our “Annual Third-Party Logistics Study” has documented that shippers view IT capabilities as an essential element of their 3PLs’ expertise. That sense has intensified over the past year as 74% of customers participating in this year’s study noted that technology plays a greater role in their 3PL partnership than it did just three years ago.

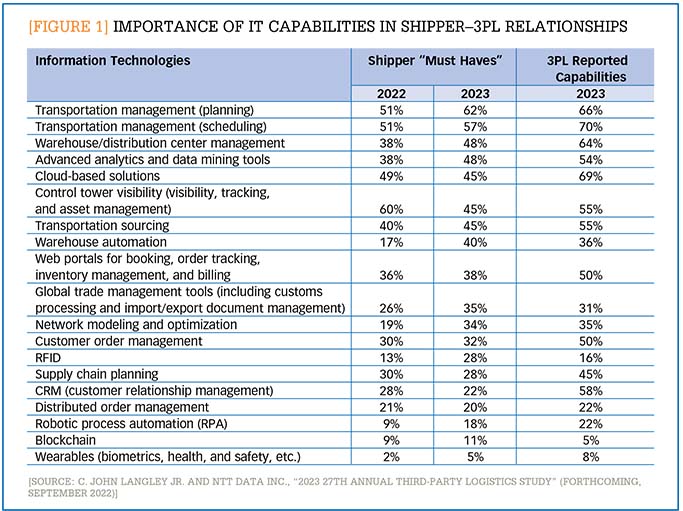

Furthermore, what customers are looking for in terms of that expertise has evolved and become more sophisticated. One question for shippers that is asked in each of our yearly studies is, “Which technologies, systems, or tools are ‘must haves’ for a 3PL to successfully serve a customer in your industry?” Figure 1 compares the results from this year’s study to those of the prior year. This figure also indicates the percentages of participating 3PLs that indicate those capabilities are currently available.

[Figure 1] Importance of IT capabilities in shipper-3PL relationships

Enlarge this image

While more traditional execution and transactional software—such as transportation management systems and warehouse management systems—continue to rank highly, there was a growing importance expressed for the availability of digital and analytical technologies. (In the interest of clarity, digitization refers to the conversion of information to a digital format, and analytics refers to the use of mathematical and statistical approaches to help solve problems intelligently using digital data.) A related finding from last year’s study is that 64% of customers noted that they were investing in intelligent data analytics. While there are some variations in year-over-year data, Figure 1 indicates there is a continued or growing interest in advanced analytics and data mining, warehouse automation, and global trade management solutions.

Findings from this year’s study indicate that this shift in focus toward digitization and analytics will continue to be of great importance for 3PLs as well. Referring to Figure 1, 54% of 3PLs reported having capabilities in the areas of advanced analytics and data mining tools. However, gaps are noted in the areas of automation and global trade management solutions.

We believe that to deal successfully with future supply chain challenges, 3PLs and their customers will require significant dedication to digitization and the use of analytics. Coupled with wisdom and experience, these analytical tools will facilitate the development of complex solutions to problems faced both individually by 3PLs and their customers, as well as those problems they face in collaboration.

Talent

The need for and availability of talent in supply chains have become critical issues for many organizations. This includes both shippers and 3PLs. Almost 80% of shippers stated that labor shortages have impacted their supply chain operations, and 56% of 3PLs stated that labor shortages have impacted their ability to meet customer service-level agreements (SLAs). In particular, roughly two-thirds of all respondents to the “27th Annual Third-Party Logistics Study” survey noted that recruiting and retaining both hourly and certified/licensed/skilled hourly workers is an area that they are struggling with and believe they will continue to struggle with for some time.

But retention challenges are not limited to hourly employees. Bloomberg, in the spring of 2022, reported that supply chain managers have been quitting their jobs at the highest rate since at least 2016.1} This assertion was based on calculations performed by LinkedIn. Each month, the website analyzes the number of people who left their job in the past month and then compares that number to a baseline average from 2016. The average “separation rate” for 2020–2021 for supply chain managers was 28%, the highest in the five years since the company started tracking this data. According to the article, factors for these turnovers include burnout, desire for increased compensation, and demand for experienced supply chain managers to solve supply chain problems at nontraditional supply chain organizations.

Further complicating the recruitment and retention challenges is the fact that supply chain roles are evolving quickly, and the skills and talents needed today are different than they were just a few years ago. For example, supply chains are increasingly becoming data-driven, and the need for real-time visibility continues to grow. As a result, skills related to data analytics and digital technologies are vital and in high demand.

Meeting the rising challenge

The success of 3PL–customer relationships always boils down to their ability to create value for their customers and their businesses, as well as for consumers and end customers. But as disruption and complexity increase, effectively meeting those needs has become even harder.

In response, 3PLs and their customers will need to work together to enhance their agility and responsiveness. Technology, data, and analytics certainly will help supply chain practitioners meet these shifting needs and implement new and innovative supply chain strategies. In addition, both 3PLs and their customers will need to ensure that they have the right people with the right skills and talents. 3PLs and customers will need to work together to establish technology and talent-acquisitions strategies that complement each other, as they work to create more resilient and effective supply chains.

Notes:

1. Daniela Sirtori-Cortina, “Stressed-Out Supply Chain Managers Are Throwing in the Towel,” Bloomberg (May 23, 2022): https://www.bloomberg.com/news/articles/2022-05-23/supply-chain-managers-are-quitting-in-unprecedented-numbers

C. John Langley Jr. (johnlangley11@gmail.com), Ph.D., is a professor at Penn State University’s Smeal College of Business and the Department of Supply Chain and Information Systems, and founder of the “Annual Third-Party Logistics Study.”

Sylvie M. Thompson is supply chain practice leader for NTT Data Inc.

Recent Articles by C. John Langley Jr.

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing