Finding normal in the face of never normal

The trucking market continues to face volatility and constant change. Here are three trends that will drive the market for years to come.

This story first appeared in the Special Issue 2021 of}CSCMP’s Supply Chain Quarterly, a journal of thought leadership for the supply chain management profession and a sister publication to AGiLE Business Media’s DC Velocity.

If there is one industry where there is no normal, it’s trucking. An industry highlighted by constant disruption, it is regularly plagued by issues varying from regulations to new technology and from asset-management obstacles to labor shortages. As trucking prepares for the end of 2021 and heads into 2022, what constitutes normal is unknown, but we project continued challenges within a few key areas of this industry.

Both consumer behaviors and business habits tend to set the stage for upstream trucking challenges. Right now, these challenges are being shaped predominantly by the changing shopping preferences of modern-day consumers—who require everything from frequent purchases, such as groceries and clothes, to one-time purchases, such as furniture, to be delivered to their doorsteps and available immediately. This shift has exacerbated existing challenges, putting immense new pressures on the trucking industry and making driver retention, cost management, and technology key strategic considerations for all carriers. All of these factors have had an impact on the trucking industry and have caused a huge increase in the linehaul rates.

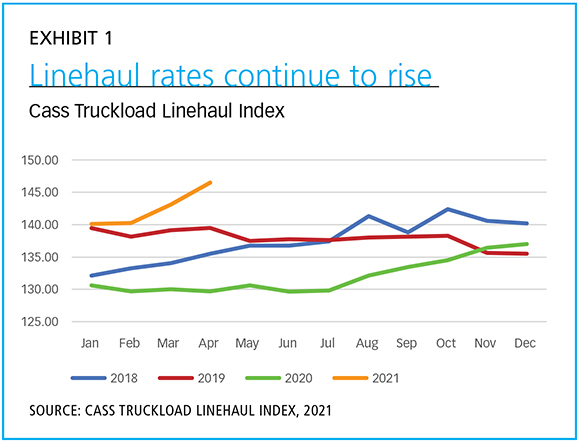

This trend is illustrated by recent results from the Cass Truckload Linehaul Index (see Exhibit 1), which has measured fluctuations in the per-mile truckload linehaul rates since its base year in 2005. The Index shows an upturn that started in June 2020, started spiking even further in early 2021, and is continuing to trend upwards. By April 2021, the Index hit an all-time high of 146.5, with a trajectory indicating that rates could continue to skyrocket.

[Exhibit 1] Linehaul rates continue to rise

Enlarge this image

As trucking prices increase, we believe that there are three pivotal areas within the industry that will determine the competitive landscape for carriers and will become the defining characteristics of 2021 and 2022: a challenging labor market; increasing focus on the “final mile”; and the need to adopt more real-time track-and-trace technology.

LABOR MARKET

While there is a shortage of truck drivers, the root of the existing challenge stems from retention. Nine out of ten drivers who start the year as a truck driver leave the industry by the end of the year.1 Driver turnover places constant strain on carriers, including the need for additional licensing, missing knowledge of specific routes or clients, and of course, training for new drivers. At the same time, the pandemic resulted in reduced commercial driver training and licensing, leading to a shortfall of nearly 200,000 drivers in 2021, which only served to exacerbate the problem.

But as with all business challenges, tension and scarcity have set the stage for innovation. New entrants to the market, such as Uber Freight or Instacart, are attempting to disrupt a long-standing cause of the driver retention problem: pay.

Historically, long-haul trucking incentives were based on a cents-per-mile compensation structure. Having a miles-driven pay structure as opposed to an hourly rate has created several issues. For example, in 2021, truck drivers averaged 56 cents for every mile driven. While this represents an increase of 4 cents per mile over 2016, that’s not enough of a raise to retain truck drivers in the long run. This is especially true as legislation around electronic logs and hours of service, which went fully live in 2017, have put a cap on the time available for a driver to make runs. Taken together, these factors mean that long-haul trucking is no longer a lucrative occupation for potential drivers.

Now new firms, as well as some companies with large in-house owned fleets, are changing driver compensation to improve retention by adding hourly rates, fixed salaries, bonuses, pay per load, and more.

FINAL-MILE INVESTMENT AND STRATEGY

The pandemic accelerated the already existing trend toward omnichannel retailing. Every product is now available to be delivered to a customer’s home at almost no additional surcharge. The increase in home delivery has placed pressure on market leaders in long-haul trucking to make acquisitions and investments within the last-mile space. Additionally traditional freight companies are facing competition from newer, more technology-based companies, like Uber Freight, which are making in-roads into the market.

However, the last-mile space is not an easy one to succeed in, as it does not offer the same revenue potential as the long-haul market. Even those leaders who thought they had a competitive advantage and an early lead within the final-mile segment have seen mixed results. They are tackling a new type of business that their legacy organizations are not structured to manage effectively. While the equipment and technology required for final-mile delivery market is the same as more traditional trucking, the dynamics are completely different—low- to no-entry barriers, fewer regulations, equipment flexibility, and lower insurance premiums. The home-delivery component of last mile adds another complicating factor into the mix: drivers now are in a consumer-facing customer service role, a completely different skill set than they’re used to. Trucking companies that have acquired smaller final-mile delivery companies have had to put in place new practices.

We forecast that several large carriers that have entered the final-mile marketplace will either separate the business or spin it off completely. At the same time, some experts think that those companies that started in the last-mile segment will begin pushing into long-haul, increasing competition with the major market players. Last mile will be a battleground area, not because it’s the most profitable for large carriers, but because they want to retain their position and market share across the entire trucking segment.

REAL-TIME TRACK AND TRACE

Pandemic-related shutdowns and bottlenecks during 2020 taught us that global supply chains are fragile and easily fractured. This realization continues into 2021, as we experience incidents such as the Suez Canal blockage in March 2021; port congestion; and shortages of key products, such as Covid vaccines and semiconductors. As a result of these disruptions, companies have grown even more focused on establishing resilient supply chains and providing real-time transparency to customers about the status of their orders.

Indeed, today’s consumers expect to have detailed information at their fingertips about their orders, and they have grown accustomed to receiving real-time updates and immediate delivery notifications. These factors are putting pressure on trucking companies to invest in technology and resources that can help them track and trace products in real time.

Market leaders have had macro track-and-trace capabilities and robust reporting tools for years, but the information from those tools is not necessarily readily available to customers. New tools that can help provide more immediate tracking and tracing range from bluetooth low-energy (BLE) sensors to cloud-based platforms, video monitoring, and machine learning.

In general, there is now a greater urgency to run a smarter fleet, which will help not only with tracking-and-tracing capabilities but also with predictive analytics. Smart fleets connected to analytics will allow trucking companies to deploy their fleet to where customers are and in a way that better meets their changing omnichannel networks.

LOOKING DOWN THE ROAD

It is safe to assume that the trucking industry will continue to be challenged by labor shortages, changing customer behaviors, and a need for enhanced technology and efficiency—as well as additional waves and variations of upheaval. While most trucking companies are not oblivious to these issues, only those that take the right steps and invest heavily to counter these factors will maintain or gain a competitive edge.

As we slowly come out of the pandemic and unemployment assistance begins to fade, available drivers and trucking capacity will increase again, and rates will likely stabilize somewhat. However, with the holiday season just around the corner, capacity will remain limited, leading to inflated rate levels into the end of 2021; rates may only drop and reach a stable level as we head into the first quarter of 2022.

Downstream, companies that depend heavily on the trucking industry for their supply chain will need to actively engage with their partner carriers to understand whether they need to redesign or diversify their distribution network. Shippers should set a clear strategy for each of their markets based on the total cost of service, profiles of their customers, and service level requirements. Market disruptions are going to be a constant, but these steps will ensure that trucking companies and their clients can stay ahead of their competitors by adopting a clearly defined strategy moving into 2022.

Notes:

1. “ATA report shows OTR driver turnover rate ‘held steady’ in Q4 of 2020,” The Trucker (March 31, 2021): https://www.thetrucker.com/trucking-news/business/ata-report-shows-otr-driver-turnover-rate-held-steady-in-q4-of-2020

Related Articles

Tyler Higgins is a managing director at global consultancy AArete and leads the firm’s retail and consumer practices.

Gaurav Joshi is a director at AArete.

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing