Home » Convoy says machine learning tech opens its trailer pool to smaller carriers

Convoy says machine learning tech opens its trailer pool to smaller carriers

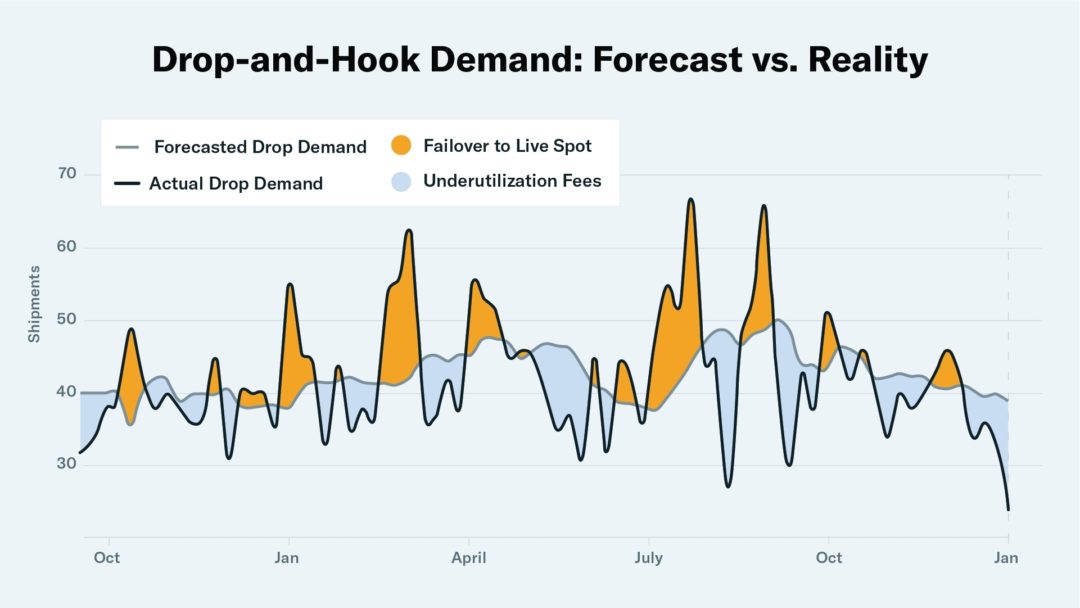

Drop-and-hook platform combines forecasts of trailer demand with real-time data from telematic sensors.

Digital freight matching company Convoy is upgrading its drop-and-hook trailer pool platform six months after its last round of enhancements, saying that advances in machine learning, predictive trailer routing, and pricing algorithms can provide shippers with improved flexibility during an era when events like seasonal storms and the Covid pandemic have contributed to unexpected surges in demand and tight freight markets.

The Seattle-based company’s “Convoy Go” service supports a process where trailers are preloaded in advance of a truck’s arrival, allowing shippers to avoid the challenges associated with “live loading,” such as tight appointment scheduling and detention fees. According to Convoy, a drop-and-hook driver can be in and out of a facility in less than an hour, whereas a live load takes three hours on average at both pickup and delivery locations.

The improved product offers a new option to shippers who have been struggling to accommodate high prices and tight capacity across warehousing and transportation markets at the same time that a recovering economy drives hot demand for goods. Other trailer pool products on the market include J.B. Hunt Transport Services Inc.’s J.B. Hunt 360box and Uber Freight’s Powerloop, as well as a collaborative trailer repositioning and sharing marketplace operated by Canadian startup vHub.

But while most shippers prefer dropped trailer pickups over live loads, traditional drop-and-hook services are inflexible because they rely on large trailer pools that must be matched with available drivers and tractors and then fully deployed for ideal asset utilization, Convoy argues. The company says that its approach is more flexible, allowing it to work beyond use cases involving contract freight with consistent volume, and apply to broader markets where smaller carriers haul more volatile volumes of freight, Convoy’s chief product officer, Ziad Ismail, said in a briefing.

The system works by using machine learning models to predict trailer demand two weeks in advance, and then combining those forecasts with historical shipment data, GPS-based trailer locations, shipment assignments, inspection reports, and driver locations, he said.

“This release allows shippers to access the long tail of carriers, because the vast majority of trucks in the market are not in large fleets,” Ismail said. “Other pools need advanced notice and run symmetrical routes, but supply chains don’t work that way; they’re more dynamic. So this is a much more powerful model.”

That approach is particularly relevant today, when pandemic forces have caused a misallocation of trailers around the country, seen in examples like automotive companies that have shut down due to computer chip shortages at the same time that consumer packaged goods (CPG) providers are seeing a spike in demand. But the overall issue has been affecting supply chains since long before Convoy launched its first iteration of the “Convoy Drop” product in 2017, he said.

TruckingThe Seattle-based company’s “Convoy Go” service supports a process where trailers are preloaded in advance of a truck’s arrival, allowing shippers to avoid the challenges associated with “live loading,” such as tight appointment scheduling and detention fees. According to Convoy, a drop-and-hook driver can be in and out of a facility in less than an hour, whereas a live load takes three hours on average at both pickup and delivery locations.

The improved product offers a new option to shippers who have been struggling to accommodate high prices and tight capacity across warehousing and transportation markets at the same time that a recovering economy drives hot demand for goods. Other trailer pool products on the market include J.B. Hunt Transport Services Inc.’s J.B. Hunt 360box and Uber Freight’s Powerloop, as well as a collaborative trailer repositioning and sharing marketplace operated by Canadian startup vHub.

But while most shippers prefer dropped trailer pickups over live loads, traditional drop-and-hook services are inflexible because they rely on large trailer pools that must be matched with available drivers and tractors and then fully deployed for ideal asset utilization, Convoy argues. The company says that its approach is more flexible, allowing it to work beyond use cases involving contract freight with consistent volume, and apply to broader markets where smaller carriers haul more volatile volumes of freight, Convoy’s chief product officer, Ziad Ismail, said in a briefing.

The system works by using machine learning models to predict trailer demand two weeks in advance, and then combining those forecasts with historical shipment data, GPS-based trailer locations, shipment assignments, inspection reports, and driver locations, he said.

“This release allows shippers to access the long tail of carriers, because the vast majority of trucks in the market are not in large fleets,” Ismail said. “Other pools need advanced notice and run symmetrical routes, but supply chains don’t work that way; they’re more dynamic. So this is a much more powerful model.”

That approach is particularly relevant today, when pandemic forces have caused a misallocation of trailers around the country, seen in examples like automotive companies that have shut down due to computer chip shortages at the same time that consumer packaged goods (CPG) providers are seeing a spike in demand. But the overall issue has been affecting supply chains since long before Convoy launched its first iteration of the “Convoy Drop” product in 2017, he said.

Today, @Convoy announced the next major evolution of drop shipments and for Convoy Go. We call it flexible drop.

— Ziad Ismail (@iamziad) May 19, 2021

A visualization of the system in action and some more about the technology here:https://t.co/sizLAY23aC

KEYWORDS convoy

Related Articles

Ben Ames has spent 20 years as a journalist since starting out as a daily newspaper reporter in Pennsylvania in 1995. From 1999 forward, he has focused on business and technology reporting for a number of trade journals, beginning when he joined Design News and Modern Materials Handling magazines. Ames is author of the trail guide "Hiking Massachusetts" and is a graduate of the Columbia School of Journalism.

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing