XPO says strong fourth quarter results show company has turned a corner from pandemic impacts

Annual profits for full year of 2020 still far down, but spinoff of contract logistics arm stays on schedule for second half of 2021.

Transportation and warehousing conglomerate XPO Logistics Inc. today pointed to consumers’ love of e-commerce for helping to drive a strong fourth quarter that helped the company recover financial momentum after pandemic pressures led to steep losses earlier in the year.

As it forges ahead with plans to spin off its contract logistics arm from its less-than-truckload (LTL) and truck brokerage division by the second half of 2021, Greenwich, Connecticut-based XPO reported quarterly revenue of $4.7 billion, the highest for any quarter in the company's 10-year history and 13% higher than the pre-Covid fourth quarter of 2019.

That revenue surge helped create fourth quarter net income of $128 million, a strong rise from the $107 million for the same quarter a year earlier. However, the rise was not enough to rescue XPO’s full year profits, which fell to $117 million in 2020 from $440 million in 2019.

Looking at future results, XPO predicted that its fourth quarter momentum would continue into the new year. The company issued a forecast of EBITDA (earnings before interest, taxes, and depreciation) for 2021 in the range of $1.725 billion to $1.8 billion. If it hits that target, it would mark a sharp improvement over a pandemic-ravaged 2020 when it recorded just $1.059 billion EDITDA, falling 16.3% from its 2019 mark of $1.265 billion.

“Our fourth quarter revenue, earnings and free cash flow were all much better than expected. The investments we made in our people and technology in 2020 helped us to generate the highest revenue of any quarter in our history,” XPO Chairman and CEO Brad Jacobs said in a release.

“We also doubled our truck brokerage net revenue year-over-year, and we improved our fourth quarter LTL adjusted operating ratio, excluding real estate gains, for the sixth straight year. The industry’s biggest tailwinds are at our back in 2021 — e-commerce fulfillment and returns, supply chain outsourcing, and fast-growing customer demand for our digital capabilities,” Jacobs said.

An XPO spokesperson cited several specific reasons for the company’s fourth quarter rebound, including a 110% jump in net revenue for XPO’s truck brokerage arm compared to the fourth quarter of 2019. Other highlight areas included steady growth in the company’s XPO Direct shared distribution network and XPO Connect mobile app, the spokesman said.

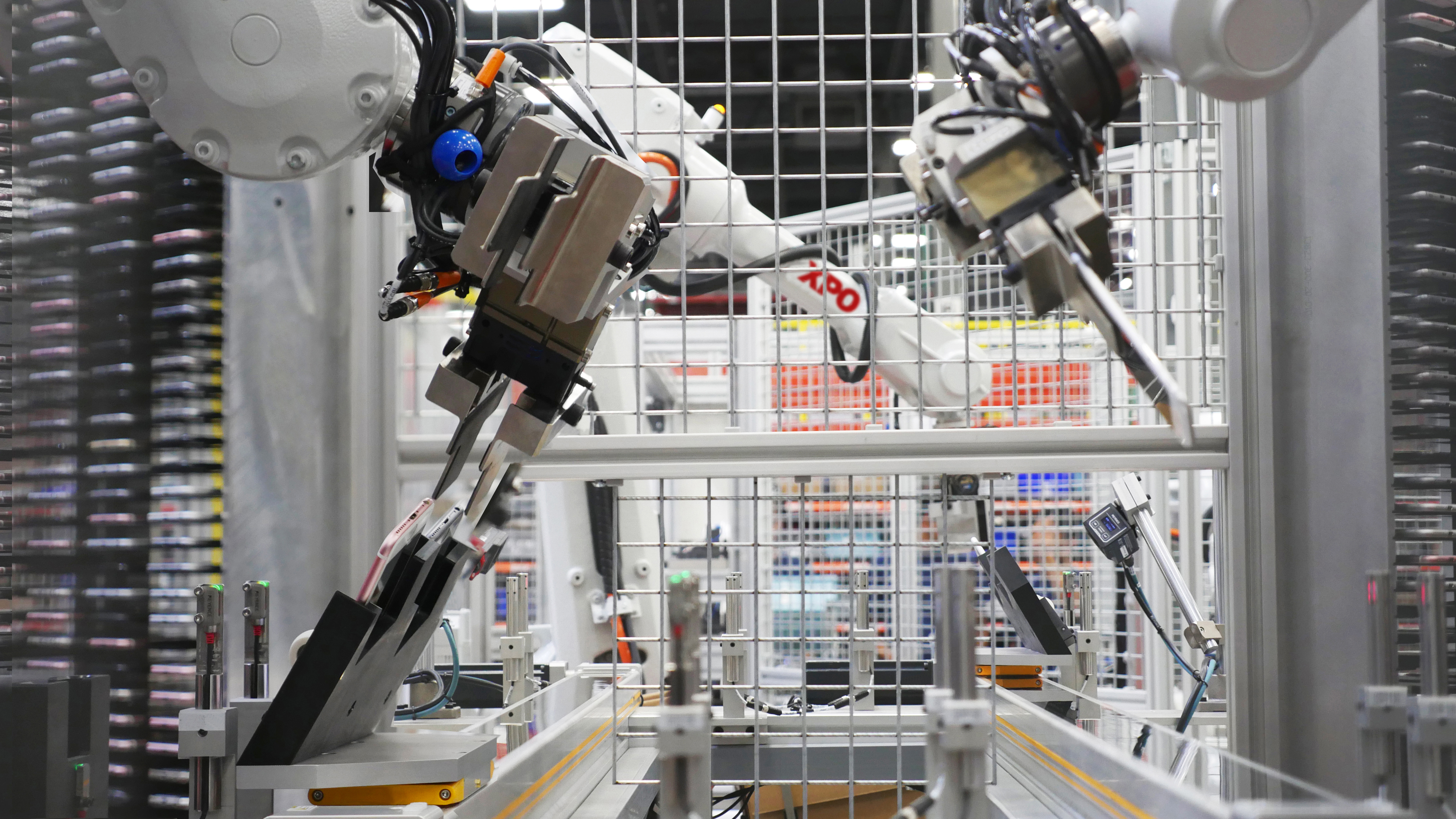

Much of that growth was supported by an increased rollout of automated systems, as XPO handled five times more inventory units using robotic technology such as goods-to-person robots and collaborative robotic arms in 2020 than in 2019. And in North America, the company applied robotic technology to more than 25% of its volume of direct to consumer e-commerce shipments in 2020, the spokesperson said.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing