LMI: Logistics industry growth continues

Logistics Manager’s Index registered 70.8 in November as e-commerce activity continues to place strong demand on warehousing and transportation.

Although growth slowed a bit in November, business activity in the logistics industry continued to expand, driven by high prices and record-low capacity in transportation and warehousing, according to the November Logistics Manager’s Index (LMI) report, released today.

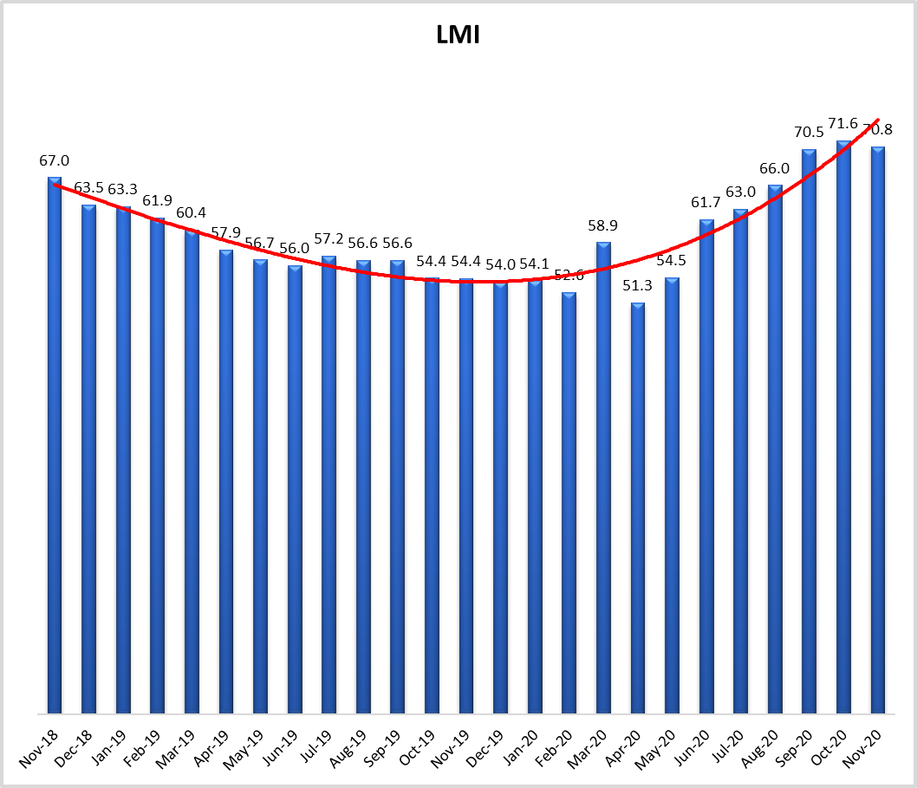

The November LMI registered 70.8, down slightly from its October reading of 71.6, but still nearly 20 points ahead of the index’s all-time low reading of 51.3 in April and well above the 50-point threshold indicating growth in the industry. An LMI above 50 indicates expansion in the logistics sector; an LMI below 50 indicates contraction.

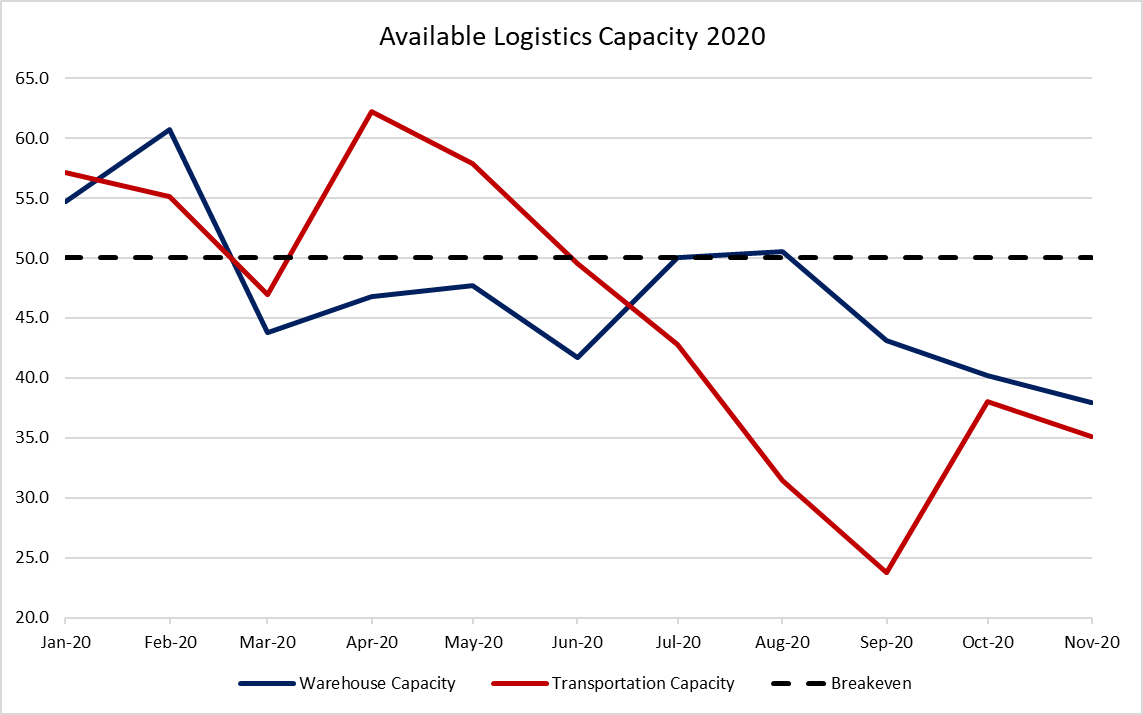

Accelerated e-commerce activity continues to spur growth because of its heavy reliance on logistics services, and LMI researchers say the trend is causing record-level contraction in both warehousing and transportation capacity. Warehousing capacity dropped to its lowest level on record in November, falling to a reading of 38 from 40.2 in October. Transportation capacity fell to 35.1 compared to 38 in October and has been contracting since June. LMI researcher Zac Rogers said last-mile demands are affecting both measures and pushing prices higher.

“Capacity is just so tight. There is nowhere to put anything,” Rogers said of the warehouse market, pointing to a general contraction in both warehousing and transportation capacity since the spring. “[Transportation has] really taken a nosedive in the last six months.”

Warehousing and transportation prices remained high during the month as well; the warehousing prices index registered 78.4 while the transportation prices index registered 85.8.

Rogers said uncertainty on many levels continues to affect the industry outlook, including uncertainty about the overall economy, Covid-19 vaccine distribution, and a potential pandemic-related stimulus bill. He said it’s leading to a rise in spot market prices for transportation services, as one example, as well as a decline in long-term business investments.

“The uncertainty associated with whether or not the e-commerce boom will continue, and when to expect an end to the lockdowns, seems to have scared some firms away from making big capital investments and/or taking up long-term contracts,” the researchers wrote.

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing