Rising e-commerce tide strands oversized goods at shoppers’ homes when returns fall short

Reverse logistics networks designed for parcels don't work when you try to return a sofa, FloorFound founder says.

A Texas logistics startup says shippers of oversized goods like furniture could tap into a new stream of revenue by using its network of regional warehouses to enable e-commerce returns that turn into online resales.

Emerging today from its “stealth phase” of development, FloorFound says it has built a nationwide network with the third party logistics providers (3PLs) J.B. Hunt, Pilot Freight Services, and Metropolitan Warehouse & Delivery. Those three partners use FloorFound’s software platform to orchestrate oversized e-commerce returns and to enable resales on the vendors’ own websites, the Austin, Texas-based firm said.

E-commerce has soared across all retail sectors during the coronavirus pandemic, and that increase is forecast to grow even larger in the coming holiday peak shopping season. E-commerce sales inevitably lead to a rise in returns, and providers of reverse logistics platforms have taken notice. For example, parcel returns platform provider Happy Returns last week announced an integration with the 3PL Ingram Micro Commerce & Lifecycle Services to support “fast and easy e-commerce returns.”

Parcel shipments represent the bulk of e-commerce, but the sector’s recent growth has also included large and oversized items, such as furniture and home fitness items ranging from couches and mattresses to Peloton exercise bicycles. Those items can be difficult to carry on conveyors and delivery trucks designed for small packages, so the trend has also seen increased investment by transportation and logistics providers in their networks for the delivery of oversized goods. Recent examples include FedEx Corp., XPO Logistics, and Pilot Freight itself.

However, despite those improvements, one glaring gap in the system is the lack of a way to return oversized items, says Chris Richter, founder and CEO of FloorFound. The cost of sending a truck and multiple laborers to pick up heavy items from consumers’ homes can approach or exceed the cost of the item itself, Richter said. So some retailers tell their customers to simply donate an unwanted couch to charity, or even throw it away at the curb.

“Everything that’s hard about a parcel return gets even worse with a freight return,” Richter said. “There are way too many totally resalable items ending up in landfills all the time just because there’s no easy way to do it. No one wants to spend $200 to bring a $100 item back to a warehouse.”

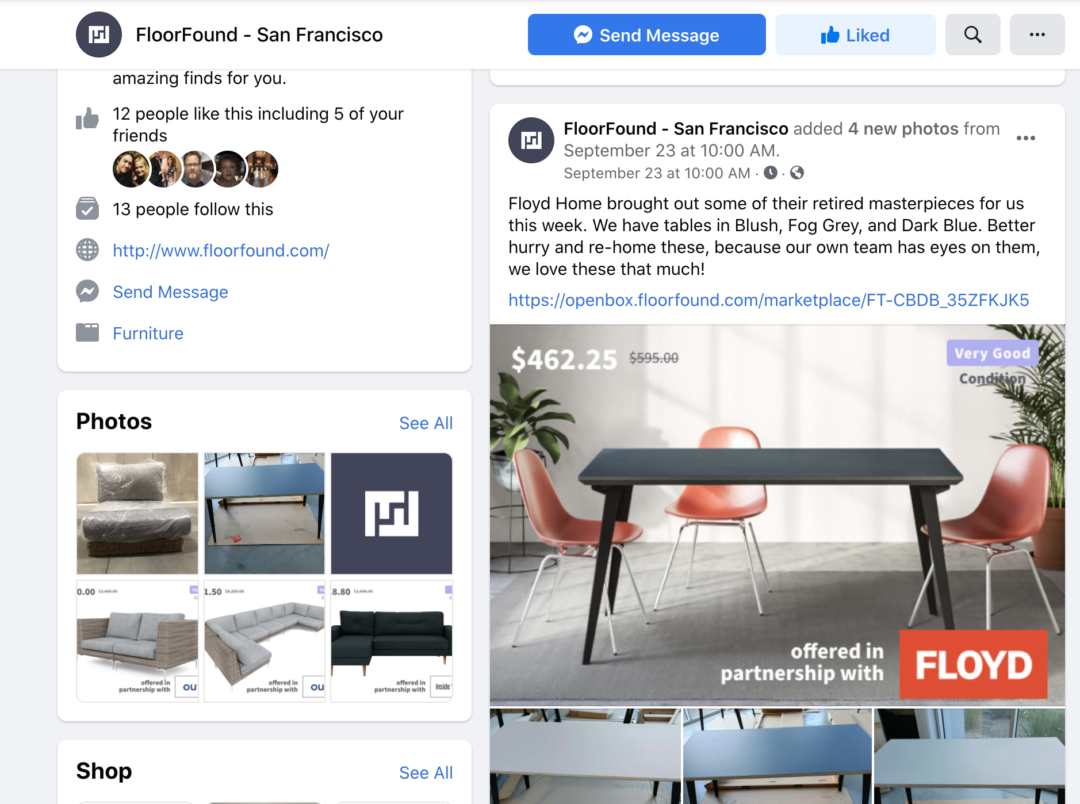

According to Richter, his firm’s “Returns Lifecycle Management” platform for oversized e-commerce shippers fills that gap by covering the transportation, inspection and storage, merchandising, and resale of oversized returns. By connecting to the FloorFound platform, warehouse and transportation providers can gain additional volume for their services, while brands and retailers can improve revenue recovery and tap into the increasing trend of resale shopping, he said.

Resale is the fast-growing preference by shoppers to buy used or returned items instead of brand new inventory, usually available at a lower price and supporting more sustainable manufacturing and consumption patterns. Brands see the trend as a new business opportunity and many have launched initiatives supporting resale, such as clothing retailer Levi Strauss and Co.’s “authorized vintage” resale program for pre-owned jeans, as well as its online store that sells secondhand clothing sourced from its own customers.

In another example, the furniture retailer Ikea made a December investment in the returns optimization technology vendor Optoro and said this week it will start buying back used furniture beginning on Black Friday.

“The broken experience of oversized e-commerce has kept a multi-billion dollar category offline,” said Julian Counihan, a general partner with Schematic Ventures, the San Francisco-based venture capital fund that is an early stage investor in FloorFound. “It's not a simple problem: oversized items require coordination of a hyper-fragmented micro-carrier network, complex physical processing, and then re-injection into an e-commerce channel that aligns with the brand. UPS and FedEx just aren't going to cut it,” Counihan said. “FloorFound will be the final push that moves the remaining offline categories, online.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing