LMI improves in May

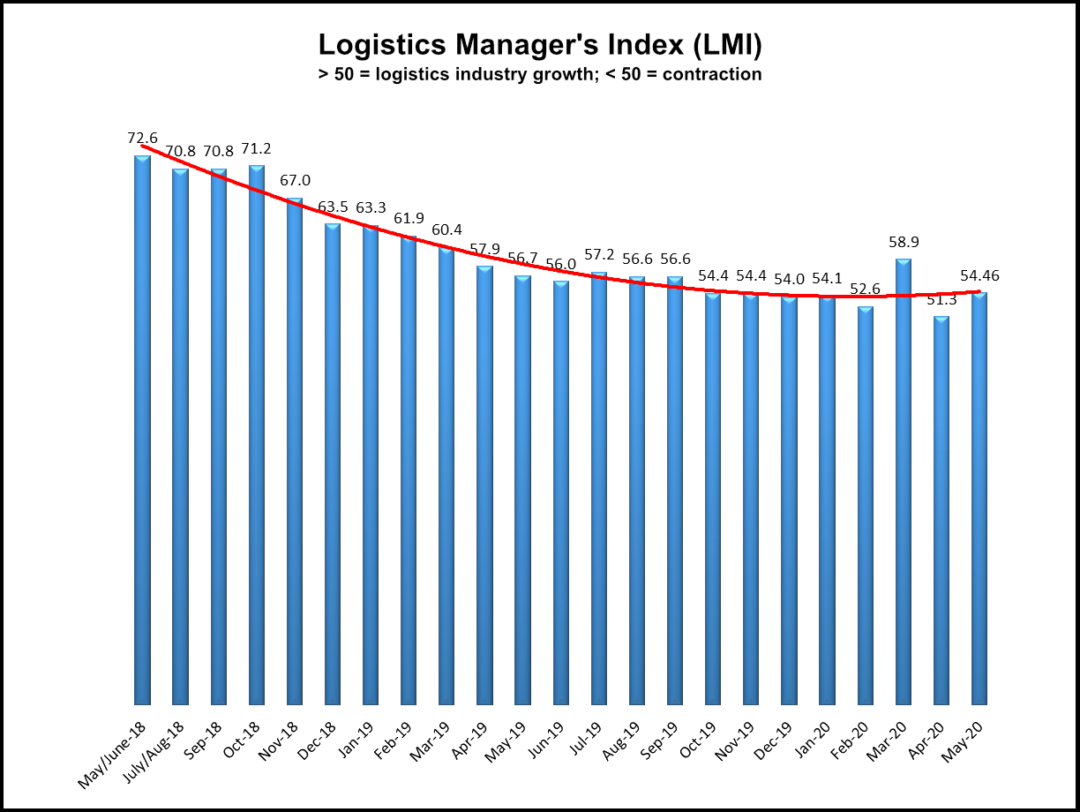

Monthly Logistics Manager’s Index rises 3.2 points to 54.5, returning industry growth to pre-Covid-19 levels.

Business activity in the logistics sector improved in May, following two months of erratic activity earlier this spring, at the height of the Covid-19 pandemic, according to the most recent Logistics Manager’s Index (LMI) report, released today.

The LMI registered 54.5 in May, up 3.2 points from April’s record-low reading of 51.3, but still more than four points below March’s reading of 58.9, when industry activity surged due to pandemic-related panic buying. The April reading is in line with the slow and steady growth LMI researchers had been tracking over the last year. The LMI, which measures business activity in the transportation, warehousing, and logistics sectors, dipped below 60 for the first time in April 2019 and remained around the 54-point mark from October 2019 to January 2020, dipping to 52.6 in February.

An LMI above 50 indicates growth in the sector; an LMI below 50 indicates contraction.

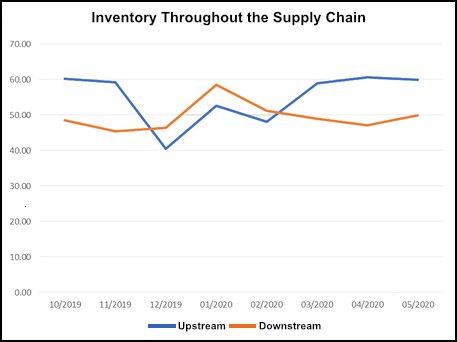

The latest results continue to show a split between inventory and transportation metrics that is setting the stage for what a potential recovery from April’s low may look like, according to LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University. Inventory levels are growing and remain at record high levels among upstream businesses—manufacturers, warehouses, and logistics firms—and warehousing capacity contracted again during the month. Transportation metrics improved, but remained sluggish.

“... this month’s LMI represents a tension between the growth in our Warehousing and Inventory metrics, and continued (albeit slowing) contraction in Transportation. This is interesting, as this is only the second time that Transportation Prices and Warehouse Capacity have both been in a state of contraction (the first time was in April),” Rogers explained in a report detailing May’s results. “That they are moving in the same direction suggests that while demand is down for Transportation, inventories remain quite high and the demand for Warehousing is up.”

Separately, Rogers said that although the slow reopening of the economy is causing “things to start moving” again, high unemployment and overall uncertainty will continue to dampen consumer demand, with retail stores limiting the amount of inventory they are willing to take on. This will force upstream businesses to find other ways to unload that inventory.

“For now, it’s got to be about getting some relief in the upstream supply chain,” Rogers said.

Rogers added that the while the industry “free fall” of the last couple of months seems to be over, a quick recovery is unlikely.

“Yes, the index is up from April’s all-time low, but it is still the sixth lowest reading in the 44-month history of the index,” Rogers said in the May report. “The ‘dip’ may be ending, but our readings seem to indicate that the recovery will not come in the quick, ‘V-shape’ that some were predicting.”

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing