Index: rail volumes and trucking spot rates may have “bottomed out” as industry eyes restart

FTR and truckstop.com collaborate on “Covid-19 Truck Freight Recovery Index,” say statistics reveal market trends.

Freight rates in the trucking spot market have “bottomed out” and will probably not continue their steep slump caused by Covid-19 business shutdowns and stay at home policies, according to a new industry index created by industry research firm FTR Transportation Intelligence and the digital freight matching platform Truckstop.com.

The “Covid-19 Truck Freight Recovery Index” is designed to provide visibility on the state of the trucking market as anticipation of an economic restart grows, Bloomington, Indiana-based FTR said.

“Because this is not a traditional economic recession, we are watching the dynamics in distinct phases that are unique to this crisis. The freight recovery index shows that a shutdown has been in full swing for several weeks and that freight is mostly bouncing along the bottom as everyone is sheltering at home,” Eric Starks, FTR chairman and CEO, said in a release.

“Once we start to see things picking up, the trajectory of the restart will help us better understand whether this is a ‘U-shaped’ recovery or a ‘V-shaped’ recovery. We expect transportation metrics to be a leading indicator of the broader economic conditions,” Starks said.

Freight professionals can use the index to gain instant visibility into market trends, as they assess trucking activity in response to the pandemic and to nascent plans for an economic recovery, Brent Hutto, chief relationship officer for truckstop.com, said in a release.

FTR released its findings on the same day it reported that rail freight volumes have also bottomed out, according to the results of another new index from the firm. FTR’s “Covid-19 Rail Freight Recovery Index” currently shows that rail volumes in the intermodal and carload sectors are likely near the bottom.

"The FTR Rail Freight Recovery Index provides necessary context to shippers and carriers on how sharp the volume declines have been in response to Covid-19 and how far away from ‘normal’ the current situation places particular commodity groups,” Todd Tranausky, FTR’s vice president of rail and intermodal, said in a release. “As the recovery continues and states slowly reopen their economies, the index will provide a valuable tool to the rail supply chain to understand where the recovery is related to pre-pandemic levels.”

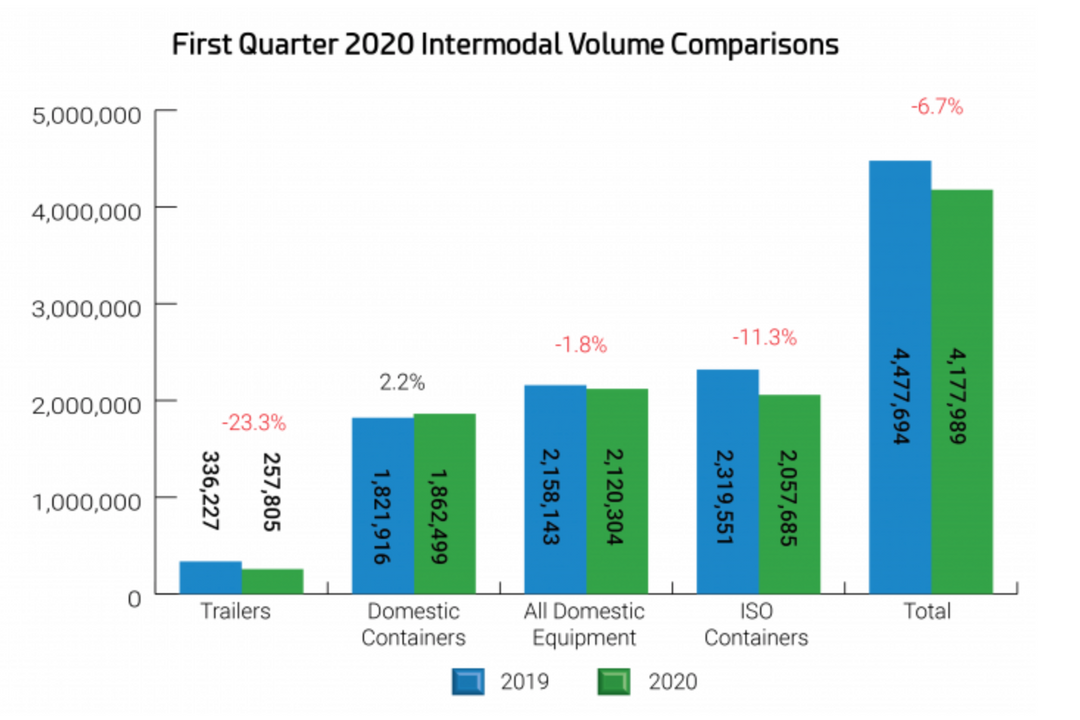

Those figures were in accordance with other statistics released today, showing that total intermodal volumes declined 6.7% year-over-year in the first quarter of 2020, according to the Intermodal Association of North America (IANA)’s Intermodal Quarterly report. While domestic containers gained 2.2% from 2019, international shipments dropped 11.3% and trailers, 23.3%.

"The coronavirus is the obvious headwind going into Q2, on top of existing trade issues, and no market segment is immune," IANA president and CEO Joni Casey said in a release. "We don't know how long volumes will remain where they are, and recovery will bring its own set of challenges."

- To see further coverage of the coronavirus crisis and how it's affecting the logistics industry, check out our Covid-19 landing page.

- And click here for our compilation of virus-focused websites and resource pages from around the supply chain sector.

Two new resources are now available to provide you with visibility on the state of the freight markets. View the COVID-19 Truck and Rail Freight Recovery Indexes now through our COVID-19 Intelligence page ?? https://t.co/pugYGFPXGp pic.twitter.com/KiuBbtdDca

— FTR (@FTRintel) May 1, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing