Online shopping surge swamps warehouses as consumers stock up during Covid-19 closures

Sudden peak in fulfillment demand triggers rise in late deliveries, Convey statistics show.

E-commerce package carriers are struggling to meet parcel delivery time estimates as retailers report a surge of orders by Americans suddenly working from home in the wake of widespread school and office closures made to combat the spread of Covid-19, according to statistics from logistics technology firm Convey Inc.

Retail orders have skyrocketed in recent days as shoppers stock up on the food and staples they will need for an extended stay in their own homes, resulting in bare shelves at brick and mortar stores and in shortages of some items at online marketplaces.

That sudden increase in volume has swamped warehouses and strained delivery networks at a team of year when retailers typically see a dip between peaks like the winter holiday season in January and rising demand for patriot furniture and other summer items in May, said Carson Krieg, co-founder and director of carrier operations at Convey.

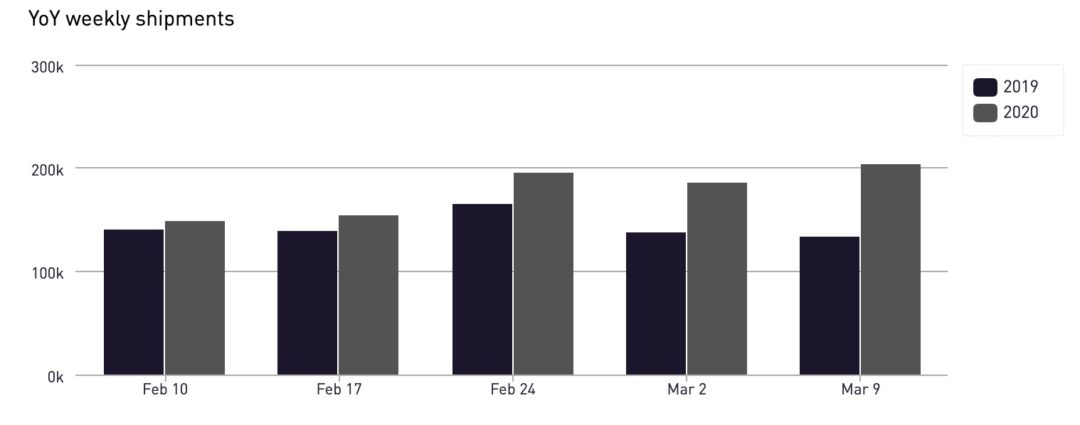

Some of the hottest demand is for cleaning and household supplies, a sector that has seen online shipping volume spike in recent weeks, rising from a blip of 6.8% up in early February to being up 52% for the second week of March, compared to the same periods last year. The statistics come from data generated by Convey’s clients, who are omnichannel and native online retailers that use the firm’s cloud-based platform to gain visibility over their shipments, from parcel to freight, and from first to final mile, Austin, Texas-based Convey said.

That surge in demand has led to “significant delays in order fulfillment and delivery” as retailers struggle to keep pace, Convey said. Order fulfillment time—a measure of the elapsed time from when a shopper clicks “buy” to when the order is picked up by the carrier for delivery—has increased almost 40% over the past three weeks, going from 15.1 hours to 21.2 hours across a wide average of retailers, the firm said.

The trend toward increase “order fulfillment time” has been even more noticeable in large-format deliveries—those that are over 150 pounds or greater than 48 inches in length—where the average fulfillment time more than doubled from 20.1 hours on February 23 to 44.4 hours on March 16. That statistic could indicate broad-based supply chain slowdowns, since those products are typically “made to order” items that are not held in inventory, Convey said.

Looking at standard sized deliveries, parcel carriers across the market have seen delays rise significantly, with the the number of packages seeing a change to their original “estimated date of delivery” rising from 2.9% three weeks ago to 4.2% today.

The delays show that the changes to consumers’ shopping patterns triggered by coronavirus mitigation policies have disrupted retailers’ customer delivery patterns and triggered a rising number of service level failures, Krieg said. “Now more than ever, in-transit visibility is paramount, so you can understand what’s happening in your network,” he said.

In response to the challenging delivery environment, Convey is now offering free access through the end of April to its “Predictive Insights” software product, which helps users identify and triangulate the root cause of network transportation issues, the company said.

So much has changed in the past few weeks -- but customer expectations around delivery have not. In our latest blog, monitor on-time performance data for top carriers, and learn how to communicate that items are on the way. #lastmilehttps://t.co/6VeBGrnoMh

— Convey (@get_convey) March 16, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing