Truckload rates could stay volatile through summer as coronavirus closures disrupt seasonal patterns, DAT says

Trucking freight rates propped up for now by rush to restock shelves, FMCSA move to lift driving hour caps.

Supply chain disruptions caused by global coronavirus shutdowns are likely to cause increased price volatility in truckload rate markets lasting through this summer, according to an analysis released today by Portland, Oregon-based loadboard operator DAT.

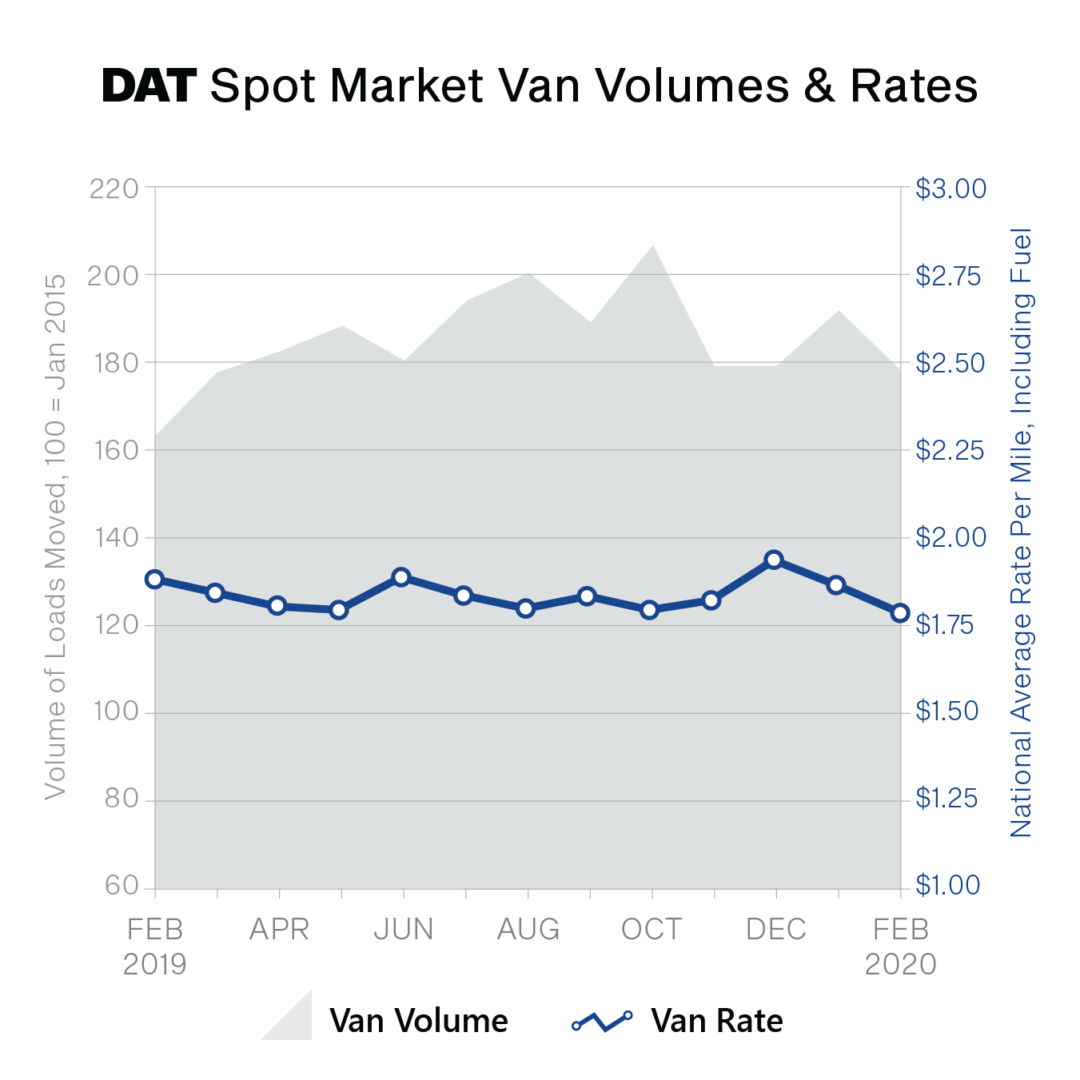

Already, truckload rates and volumes declined in February for the overland modes of dry van, refrigerated, and flatbed equipment, DAT found. For example, spot van rates averaged $1.79 per mile nationally in February, down 8 cents from January and 9 cents from February 2019.

On its own, that statistic is not surprising, since the decrease tracks with typical seasonal trends related to the shuttering of factories throughout Asia for Lunar New Year. However, in 2020 those closures have continued far beyond their usual duration due to efforts to curtail the spread of the Covid-19 disease, so truckload demand in West Coast port markets is likely to be slower than usual to rebound.

“Ocean and air cargo was affected immediately by the coronavirus-related cutbacks,” Peggy Dorf, senior market analyst at DAT Solutions, said in a release. “That will certainly affect truckload freight later, but for now carriers are busy helping retailers restock empty store shelves.”

One factor propping rates up for the time being is a rush by truckers to resupply groceries and consumer packages goods (CPG) inventory in stores nationwide as consumers fill their pantries in reaction to school closures and the cancellation of many public events. That demand grew even hotter on Friday when federal regulators relaxed the traditional cap on drivers’ Hours of Service (HOS) limits behind the wheel, allowing truckers to log extra time hauling emergency materials such as medical supplies and food staples.

Following that move by the Federal Motor Carrier Safety Administration (FMCSA), the nation’s top railroad regulator took a similar step. On Saturday the Federal Railroad Administration (FRA) declared a state of emergency, offering a temporary lifting of certain rail regulations after finding that “the imminent threat and exposure to the Coronavirus Disease 2019 (Covid-19) poses a risk of serious illness that constitutes an ‘emergency situation’.”

The truckload market’s volatility is being caused by tightening supply conditions forced by the simultaneous surge in demand for consumer staples and an incremental reduction in supply, according to a report from the investment firm Baird Equity Research.

Those supply chain disruptions could be beneficial in the long run to truckload business fundamentals. But in the meantime, the sector will see rising demand risk through the first half of 2020 due to factors such as rising insurance premiums, shrinking driver availability, and the broadening pandemic, the Baird report said.

“This is an unprecedented period with still-unknowable impacts, making attempts to forecast future aggregate demand impossible,” Benjamin Hartford, a Baird senior research analyst, said in a release. “The cascading closures of events nationwide and globally in recent days will be essential in arresting the virus' outbreak. Meantime, the acuteness of the economic impact could exceed anything we've experienced in our lifetimes -- including the 2008-09 financial crisis.”

Despite that warning about the freight sector’s volatile future, the Baird report closed on an optimistic note, quoting British war-time prime minister Winston Churchill as saying “The optimist sees the opportunity in every difficulty.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing