Maritime container rates hit all-time high, Drewry says

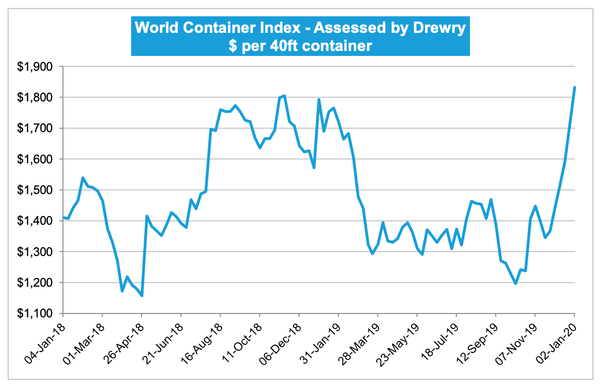

A composite index of non-contract—or "spot"—container rates increased 15.1% this week, up 2.2% compared to the same period last year and good for an all-time high, according to a report today from the U.K. shipping consultancy Drewry Shipping Consultants Ltd.

The average composite index of the firm's "World Container Index" year-to-date, is $1,832 per 40-foot container, which is $438 higher than the five-year average of $1,395.

Just six months ago, that same index was mired below $1,400, far below its most recent spike in 2018, as global freight markets struggled with an ongoing U.S.-China trade war, geo-political tensions such as Brexit, and new emissions regulations for container ships.

Drewry compiles the index as a composite of container freight rates on eight major routes to and from the U.S., Europe, and Asia. Despite the large swing in price, Drewry expects rates to remain stable in the coming week.

The latest jump was driven by sharp weekly gains on transpacific trade; spot rates from Shanghai-to-Los Angeles rose 25% or $356 to reach $1,791 per feu. Similarly, rates on Los Angeles-to-Shanghai gained 28% and touched $521 for a 40ft box. Freight rates on Shanghai-to-Rotterdam spiked by $326 this week, and as well 12% above than a year ago. Likewise, Shanghai-to-to Genoa index continue to grow by 13% and stood at $2,689 per 40-foot container.

Viewed on an annual scale, rates are also up on all eight lanes with three exceptions: Shanghai-to-New York, down 20%, Shanghai-to-Los Angeles, down 14%, and New York-to-Rotterdam, down 10%.

Our composite index surged by 15% this past week with the biggest increases seen on transpacific trade. https://t.co/QFx0ZAo0zG Please register and login to read the detailed assessment #worldcontainerindex #containershipping #drewry pic.twitter.com/xuFtPp2Fb8

— Drewry (@DrewryShipping) January 2, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing