Forecast: U.S. truck market mired in neutral conditions through first half of 2020

As the truckload freight industry continues absorbing the blow of the sudden bankruptcy of former top-20 carrier Celadon Group yesterday, a new report says business conditions in the sector improved slightly in October but are on track to remain no better than neutral "at least through the first half of 2020."

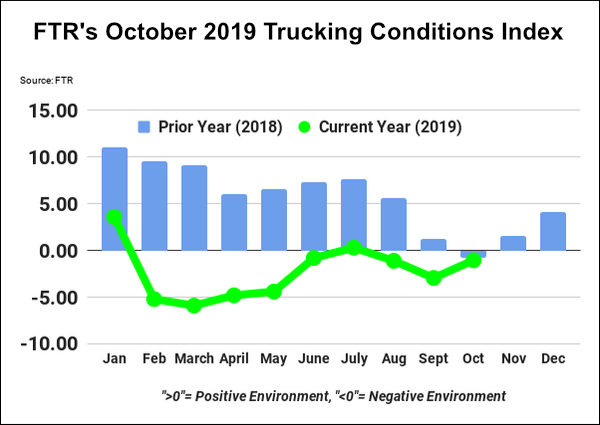

Generated by freight industry tracking firm FTR, the Trucking Conditions Index (TCI) report for October was -1.04, staying mired in negative territory despite a push from rising freight demand.

Bloomington, Ind.-based FTR produces the index by tracking the changes representing five major conditions in the U.S. truck market—freight volumes, freight rates, fleet capacity, fuel price, and financing—and combining them into a single number. Positive numbers mean strong conditions for carriers—allowing them to charge high freight prices to shippers—while a zero reading indicates that truck supply and demand are roughly in balance.The index's negative rating for October represents a steep fall since it hit a record high of 15.41 in February 2018.

Looking into the future, FTR expects trucking to hold steady in a mediocre environment with the TCI hovering close to a neutral reading at least through the first half of 2020. Major trends causing that result are a "sluggish" industrial economy balanced by strong housing numbers that give some cause for optimism, the firm said.

"Although we continue to see high-profile trucking failures - often due to internal management issues - we see a generally stable environment for the industry," Avery Vise, FTR's vice president of trucking, said in a release. "Manufacturing is weakening, but residential construction is firming, and job growth and consumer spending remain strong. While we expect little freight growth in most segments, volume remains solid by historical standards."

The citation of "internal management issues" was a reference to both Celadon and Roadrunner, large truckload carriers which are both in the throes of financial disarray, following the revelation that former executives at the companies had hidden illegal accounting practices.

While the companies' failures could mark a slight consolidation of the industry and redistribute freight volume to surviving competitors, that impact will be too small to pull the sector out of the doldrums anytime soon, according to a report from ACT Research Co., the Columbus, Ind.-based analyst and forecasting firm. ACT Research today released the December installment of its "Freight Forecast, U.S. Rate and Volume OUTLOOK" report covering the truckload, intermodal, LTL, and last mile sectors.

"We expect capacity to rebalance over the course of 2020, but we caution not to jump to the conclusion that capacity is tightening because of carrier failures," Tim Denoyer, ACT Research's Vice President and Senior Analyst, said in a release. "While our thoughts go out to the affected employees, even the largest bankruptcy in truckload history this week accounts for just 0.2% of the active fleet, or about 3% of the Class 8 tractor capacity that was added over the past year, and the equipment will be remarketed."

In greater context, ACT is forecasting a lengthy freight recession as the trucking sector suffers from a lack of volume as international trade is hamstrung by U.S. tariffs on Chinese goods, the report found. "This is the largest year-over-year drop in container imports since the Great Recession, aside from holiday timing. While partly due to the comparison against pre-tariff inventory building last year, we see evidence that trade issues will continue to drag the freight cycle through the mud," Denoyer said.

Freight Forecast: Lowering Truckload Spot Rate Forecasts on Freight Demand; What Could Drive Rates Up in 2020?https://t.co/DrFwTz88pU

— ACT Research (@actresearch) December 10, 2019

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing