Report: logistics sector will rise to second place in use of collaborative robots by 2023

Applications led by material handling, assembly, and pick & place, Interact Analysis says.

Vendors shipped more than 19,000 collaborative robots—or cobots—in 2018 as they generated a faster increase in global revenue than any other sector of the robotics industry, led by applications in material handling, assembly, and pick & place, a new study shows.

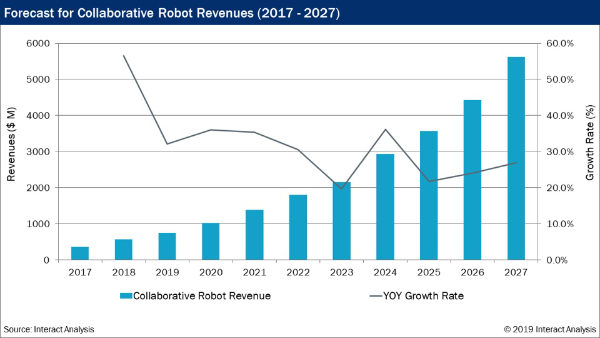

In 2018, global revenues from cobot production exceeded $550 million, almost a 60% increase over 2017, according to "The Collaborative Robot Market - 2019," a report from British market research firm Interact Analysis. The group forecasts that cobot revenue will continue climbing and is on pace to reach $5.6 billion in 2027, accounting for almost one third of the total robotics market, the group said.

Much of that growth will be driven by the logistics sector, which will surpass automotive to become the second-largest end-user of cobots by 2023, following electronics in first place.

While the top three use cases—material handling, assembly, and pick & place—accounted for 75% of cobot revenues in 2018, they will drop to below of 70% total revenues by 2023, as other functions for cobots are developed, Interact Analysis said. Specifically, the use of cobots in non-industrial applications will play a significant role in that change, thanks to the rising popularity of cobots in sectors such as life sciences, logistics, and hospitality.

Cobots are gaining increased use in new sectors because they are flexible and easy to set up, making them attractive to smaller companies which may not have previously considered using robots, the group said. For example, one of the hottest slices of cobot industry growth is among small-sized units, with robots weighing in below 11 pounds or between 11 and 20 pounds predicted to represent the majority of sales in 2023 as users deploy them in small to medium-sized industrial settings.

"The collaborative robot market is still relatively immature, but Interact Analysis has identified clear potential growth areas, both in industrial and non-industrial settings, enabling manufacturers to respond effectively, and take full advantage of what we predict to be an area which will occupy a significant market share in the coming years," Maya Xiao, lead analyst on cobots for Interact Analysis, said in a release.

Collaborative Robot Sales will reach $5.6bn by 2027!

— Interact Analysis (@IA_Analysis) December 3, 2019

Read our latest insight here: https://t.co/cxiS5PS2Ia#cobots #robotics

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing