Upload your press release

Absorption spurred by robust activity, Class A rent hits high

STRONG ABSORPTION, VACANCY REMAINS LOW

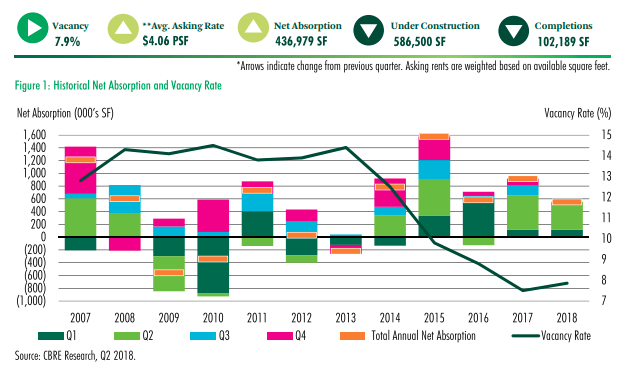

Q2 2018 net absorption in the industrial market more than tripled over Q1 2018 but was 100,000 sq. ft. less than Q2 2017. However, Q2 2017 absorption included 320,000 sq. ft. of delivered build-to-suits (BTS) while Q2 2018 saw only a 15,000 sq. ft. BTS project. The market-wide vacancy rate was flat quarter-over-quarter due to the delivery of a vacant speculative project and database adjustments. At 13.4%, Class A saw the only significant decline in vacancy, falling by 130 basis points (bps) since Q1 2018 and 140 bps since Q2 2017.

MARKET ACTIVITY DRIVES UP ASKING RENTS

The market registered over 1.5 million sq. ft. of activity which was almost evenly divided between new leases, renewals, and investment sales. Class A product accounted for 70% of leases and renewals and 90% of the quarter's net absorption. All classes saw positive absorption during the quarter and no new major vacancies were recorded.

Average asking rents increased across all classes and most submarkets compared to Q1 2018. Market-wide rents were up by $0.04 per sq. ft. since last quarter and $0.03 per sq. ft. annually Class A had the strongest rent growth increasing by $0.07 per sq. ft. to $4.50 per sq. ft., a new cycle record.

SPEC DELIVERY, TWO BTS START CONSTRUCTION

An 87,000 sq. ft. speculative development was delivered in Q2 2018, making the current product pipeline exclusively BTS development. Two new BTS projects began moving dirt and one 15,000 sq. ft. project was delivered, closing the quarter with a total of seven projects under development.

More Info: https://www.cbre.com/research-and-reports/El-Paso-Industrial-MarketView-Q2-2018

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing