Upload your press release

In Texas, positive net absorption and healthy construction in industrial continue into 2018

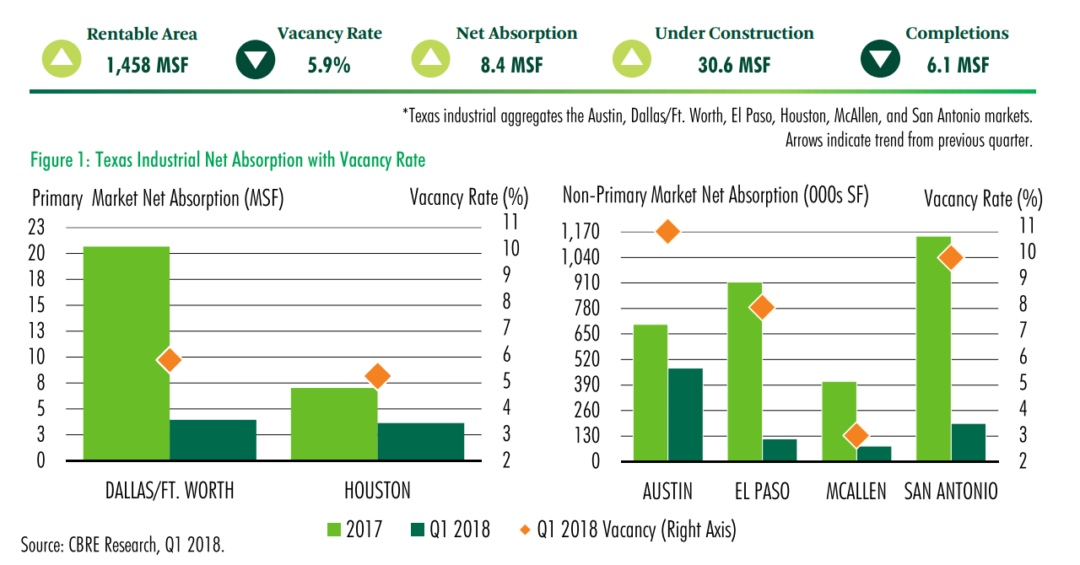

While some submarkets saw negative quarterly occupier growth, all tracked Texas markets remained in overall positive territory. Statewide, 90-day net absorption increased by almost 2.0 million sq. ft. This was due largely to Houston's absorption growth of 2.5 million sq. ft. Additionally, about 62% of delivered construction was pre-leased. This occupied growth in inventory combined with robust leasing activity pushed down Texas industrial vacancy to 5.9%, down from 6.3% in Q4 2017 and 6.2% a year ago.

Following a record quarter of new construction starts late last year and a scoring year of deliveries, industrial construction activity steadied. Dallas/Ft. Worth leads in new starts but with a smaller margin compared to previous quarters. Austin and McAllen saw quarterly growth in both new starts and total space under construction while El Paso and San Antonio just the opposite. Statewide, total space under construction was slightly above Q4 2017 and nearly 5.0 million sq. ft. higher than Q1 2017

More Info: https://www.cbre.com/report-download?PUBID=55613f9b-f563-4360-953a-820f2c485301

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing