Reality check

Buyers and sellers have battled over control of inbound shipments for decades. But in today's tough economy, that conflict has intensified as buyers—especially retailers—step up their efforts to cut supply chain costs.

As part of these efforts, buyers are looking at whether they could save money by assuming control of the inbound move, instead of paying whatever the seller charges to deliver its freight to the buyer's door. To help make this determination, many are turning to transportation management systems (TMS). Because this type of software allows them to model so-called "what-if" scenarios, it's a useful tool for weighing the pros and cons of taking over responsibility for inbound moves. But, experts caution, logistics managers should not assume they will automatically reap all the benefits the model suggests are available.

MODELING THE "WHAT-IFS"

The growing interest among buyers in managing inbound freight was highlighted in a recent Kane Research study, "Key Supply Chain Challenges of Mid-Sized CPG Companies." A number of the 110 consumer packaged goods executives who participated in the study reported that the retailers they do business with want greater control of inbound freight than in the past.

That's not surprising given that many retailers believe their market power allows them to negotiate more favorable rates with truckers than their suppliers could. But the desire to control inbound shipments isn't just about money. "Retailers also want to use their preferred carriers to ... ensure that they are working with the carriers that understand the retailer's specific needs and requirements," says study co-author Brian Gibson, a professor of supply chain management at Auburn University in Alabama. In addition, a retailer that operates a private fleet may have another motivation for wanting to take control of its inbound shipments: It may be able to reduce empty miles by picking up an inbound shipment from a vendor after delivering an outbound load in the same vicinity.

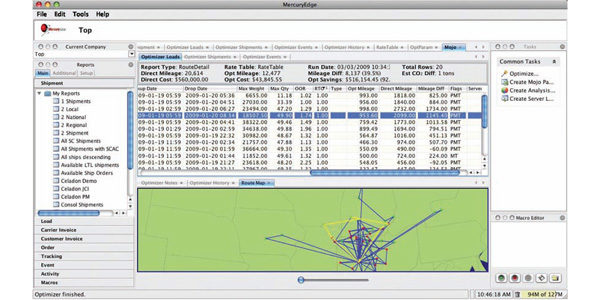

In order to decide who should control inbound freight, shippers first need to do an analysis. And a TMS gives them a tool to weigh the tradeoffs. For instance, Monica Wooden, chief executive officer of the TMS developer MercuryGate International Inc., reports that a number of her company's retail clients, including Dillard's, Bed Bath & Beyond, and Walmart.com, have recently used a TMS for evaluating inbound options.

How does a TMS help with such an analysis? For starters, it can model whether a proposed shift in control of inbound transportation might allow a buyer to obtain a lower rate on a specific lane. "A what-if analysis can determine what it will cost me on a per-unit basis if I take on control of transportation of this product," explains Derek Gittoes, vice president, logistics product strategy at Oracle, which offers a TMS. "I can then compare that with the current freight cost."

TMS modeling can also help users determine whether a buyer could tap into its carrier network to coordinate pickups with deliveries, either with an existing for-hire trucker or with its private fleet. In this way, the TMS can provide the visibility needed to make better decisions regarding inbound transportation expenditures, says Chuck Fuerst, director of product strategy at TMS provider HighJump Software Inc.

Increasingly, that visibility is expanding beyond domestic boundaries. Historically, when companies have used a TMS to assess the cost implications of handling their own inbound shipments, they have looked only at truck movements within the United States. But some are starting to use this type of software to examine inbound air or ocean shipments from overseas suppliers. "I expect to see more growth for doing this on the international side," says Fabrizio Brasca, vice president of global logistics for JDA Software Inc., another TMS provider. "There's a growing trend for larger retailers to look at this analysis from origin to ultimate destination."

THE MATCH GAME

Because modeling requires time and resources, this type of analysis should not be undertaken lightly. Before getting started, a shipper should have at least some idea where savings opportunities might be found, cautions Roy Ananny, a senior manager in the transportation practice of the consultant Chainalytics. If the shipper operates a private fleet, for example, the company might focus on identifying potential backhauls.

Alternatively, the buyer might want to look at the vendor's pricing—that is, whether the supplier is charging more for the inbound delivery service than the going for-hire rate. If a vendor includes a "freight allowance" on the bill, it's fairly easy to tell whether that's the case. A freight allowance is the amount the manufacturer will deduct from the bill should the buyer pick up the freight. By law, the freight allowance must reflect the seller's actual cost for moving the goods. "The easiest way to justify a TMS modeling is if the freight allowances along lanes are [higher] than the market rate," says Ananny.

Unfortunately, not every manufacturer breaks out the inbound transportation cost on the bill of sale. "If the vendor is covering the freight himself, he may not tell you his rate cost," Ananny warns.

Still other buyers might find it worthwhile analyzing their network for opportunities to pair headhaul and backhaul trips—a move that would likely allow them to negotiate better rates. To determine whether such opportunities are available, Ananny says, shippers can pull data from their purchase order system and feed it to the TMS as if it were an instruction to set up a shipment. If the system indicates, for instance, that the product associated with a particular purchase order will be available tomorrow afternoon on the supplier's dock, the buyer could pick it up with the same vehicle used to make a delivery to a nearby location earlier in the day. "Both freight requirements must come together," he says.

GOOD IN THEORY ...

All of this is good in theory, but it may be hard to achieve in practice, even with help from a TMS. The coordination of outbound and inbound transportation can be complicated and expensive. Furthermore, logistics managers have to temper the simulation's results with their own assessment of the vendor's ability to stick to a schedule.

"In real life, as a shipper, you don't have a lot of control over the vendor's dock facilities," Ananny points out. If a vendor can't meet its commitments, it could throw off plans to pick up and deliver multiple shipments on a single run. "The vendor says, 'Come here at 10 a.m.,' but [suppose] there's an unforeseen circumstance and you don't get loaded until 2 p.m. The second pickup is in jeopardy because that vendor doesn't stay open long enough to accommodate the delay," he says. Even if the TMS suggests multiple pickups are possible, in reality, the success rate will be less than 100 percent, he adds.

And there's another potential obstacle: Suppliers may be unwilling to renegotiate the terms of sale to accommodate a buyer that wants to take control of its inbound moves. "The vendors may not be willing to change the way they do business with you," Ananny says. "The vendors may say, 'You can pick up the freight, but we're not going to change our price.'"

Indeed, many suppliers are resistant to handing over inbound control because they, too, want high shipment volumes to use as leverage when negotiating with carriers. "Suppliers who also have scale benefits resist giving up a portion of their scale to select customers simply because it would de-scale their network," explains Kumar Venkataraman, a partner in the consumer industries and retail practice at the consulting firm A.T. Kearney.

The takeaway: Although a transportation management system can be valuable in helping shippers identify potential benefits of controlling inbound transportation, logistics managers should conduct any modeling exercise with their eyes wide open. "TMS modeling can play a role in quantifying the value as long as people doing the modeling are aware of the things that can go wrong," Ananny says.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing