Stepping on the gas: interview with T. Boone Pickens

No one needs to prove themselves at 84 years of age, and T. Boone Pickens is no exception.

Over the past 50 years, few have strode so visibly as Pickens across America's energy stage. But at a time when he could step back to savor a life well lived, Pickens has instead embarked on a project that will dwarf anything he or any other energy titan has ever done.

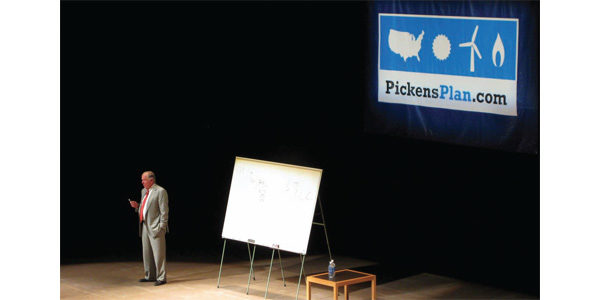

Pickens' mission—born from his now-famous 2008 "Pickens Plan"—is to convert the nation's 8 million heavy-duty trucks from diesel fuel to cheaper, cleaner-burning natural gas. It is a multiyear effort that calls for persuading U.S. fleet owners to commit to investing in more expensive vehicles that run on natural gas. It also requires the development of an extensive infrastructure to provide fuel and maintenance to over-the-road truckers. Pickens sits on the board of a California-based company, Clean Energy Fuels Corp., that is involved in such an endeavor.

If the conversion program works, it will change the global energy game in profound ways, with the impact being felt long after Pickens and most of us are gone.

Pickens spoke recently with DC Velocity Senior Editor Mark B. Solomon about the project and its challenges and implications.

Q: Do you have a realistic number for the size of the conversion potential?

A: Eight million trucks out of 250 million vehicles in America. Heavy-duty trucks use 20,000 to 30,000 gallons a year. That totals 3 million barrels a day. We import 4.4 million barrels a day of OPEC (Organization of the Petroleum Exporting Countries) crude. So you can knock out 70 percent of OPEC oil by going to domestic natural gas for heavy-duty trucks.

Q: The biggest challenge at this point is building out a robust natural gas fueling and maintenance infrastructure. Can this network be developed without some form of government assistance?

A: What you want to get from the government is a tax credit to offset the $24,000 cost differential between diesel and natural gas trucks. That differential will be there for a while because of the size of the engines. Eventually, the differential will disappear because you can otherwise build natural gas engines as cheaply as you can build diesel engines.

Because natural gas is cheaper than diesel, the fuel savings will be such that you won't need federal money for the infrastructure. The conversion is going to happen without government help. What you want from the government is the help to make it happen faster.

Q: What is your time frame for this conversion?

A: Five years with government leadership, 10 years without leadership.

Q: As we talk, oil prices have come off their highs, while natural gas prices have begun climbing from historic lows. Do you have projections as to where these prices will be a year from now?

A: About $115 a barrel for Brené North Sea crude (world oil prices), and $95 to $100 a barrel for West Texas Intermediate crude (domestic). Natural gas prices will probably be at $3.50 to $4 per million BTUs (British thermal units).

Q: Many natural gas producers have scaled back production because prices are not compensatory for their investments. That could explain why prices have been rising lately. What would be a good price point for natural gas that would encourage production but not choke off demand?

A: $5 [per million BTUs] would put producers back to work.

Q: What's it going to take to maintain the industry momentum to convert from diesel?

A: The fuel is cheaper. That's the bottom line. If I am competing against you and you can cut your fuel bill by a third, I have to do the same thing to be competitive with you. That's where the industry is. It's happening right now.

Q: Does it require shipper buy-in, or is this something truckers will do independent of shippers?

A: Shippers are asking for this. They want to get away from the diesel surcharge. There is no surcharge on natural gas. Shippers are asking for two prices for shipping, natural gas and diesel.

Q: How much will it cost to modify each station to accommodate natural gas refueling?

A: About $1.5 million to $2 million a station for liquefied natural gas. The exact figure would depend on site improvements, which include driveway ingress/egress, retention ponds, landscaping, lighting, and street and curb improvements. If stations add compressed natural gas, special equipment and dispensers would add about $750,000 to the cost.

Q: You've said you support Mitt Romney's candidacy because he has a credible energy plan, whereas President Obama has had three and a half years to deliver one and has not. Have you discussed your conversion plan with Gov. Romney?

A: I've talked to Romney, and I've talked to Obama. Obama has talked about a 100-year supply of natural gas. But I haven't seen anything come out as a plan. I was in Denver in 2008 [for Obama's nomination acceptance speech] when he said that in 10 years, we wouldn't be importing oil from the Middle East. I've never heard him mention it again, and I've never seen a plan to accomplish this.

Q: Several people, including you, have raised concerns about U.S. producers' being able to export natural gas supplies overseas to obtain a better price for their products. Do you think there should be quotas, or even an outright ban, on U.S. natural gas exports so the product stays in domestic hands?

A: I'm not big on that. I think what should be done is to increase the demand in the United States and take advantage of it. I understand the economics. Producers are trying to get into a global market because natural gas prices here are at $2.78, and in Europe it's $14, in Beijing it's $14 to $16, and in Japan it's $18.

The United States has the cheapest fuel in the world. Natural gas is a fraction of the cost overseas, our domestic oil is $15 a barrel cheaper than world oil, and pump prices are much lower than in Europe and Asia. But when it comes to natural gas, you have to give your producers a chance to get a getter price. Either let them do it or move to develop demand in the United States. If your leadership would do it, you could develop demand right here.

Q: The core of the 2008 Pickens Plan was to make wind power a primary source of energy and convert natural gas from a primary energy source to a transportation fuel. Yet the plan never really gained traction largely due to resistance to wind power investment. What happened?

A: Wind power is priced off the margin, and the marginal price is set by natural gas. When the proposal came out, natural gas was fluctuating in the $7 to $13 range. But when you get below $6, which is where we've been, you can't finance a wind deal.

Q: Do you still believe in the concept?

A: When natural gas gets above $6, you can use wind.

Q: How much of the overall problem rests with elected officials and the federal bureaucracy?

A: In Washington, they need to understand the portfolio of fuels—and opportunities to use the fuels—better than they do.

Q: They don't understand the economics of it?

A: You can start there. People think it's a free market for oil. It's not a free market for oil. OPEC sets the prices. Twenty million barrels come through the Strait of Hormuz every day. Only 7 percent of that goes to the United States. But we have our military over there to protect that. According to a study by the Milken Institute, we spent $7 trillion from 1978 to 2010 on Mideast oil. A great part of that was military spending, but it's still connected to the price of oil.

In the last 10 years, we have transferred $1 trillion of wealth to OPEC oil producers. That's the largest transfer of wealth in the history of mankind. If this continues for the next 10 years, assuming a price of $100 a barrel, it will cost $2.5 trillion. This is not sustainable.

What we need to know is what's in the energy portfolio, how we deploy it, what's available in the United States, and what could be available in a North American energy alliance. That goes a long way toward getting us where we need to be. The resources here are adequate and available, and you don't need the cost of oil from the Mideast.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing