Industry growth continues to slow, LMI report shows

Business activity in the logistics sector expanded in October, but the rate of growth continued a downward trend that began in April and has researchers pointing to a cooling of the sector and the broader economy. The Logistics Manager's Index registered 54.4 in October, down 2.2% compared to September and down nearly 15% compared to a year ago, according to the latest Logistics Manager's Index (LMI) Report, released today.

"We are still seeing growth, but at the slowest rate we've seen in three years," said Zac Rogers, LMI analyst and assistant professor of supply chain management at Colorado State University, one of five academic institutions that jointly produce the LMI report.

The LMI registered 60 or above from September 2016 through March 2019, hitting a record high of 75.71 in the spring of 2018; this is well above the 50-point mark indicating growth in the sector. The lowest seven scores in the history of the index have all occurred within the last seven months, the researchers said.

Rogers said slow growth in inventory levels and a contraction in transportation prices drove October's lower growth rate. Inventory levels held steady compared to September but were down 7% compared to a year ago and down 16% compared to October 2017, contrary to what is expected in the run-up to the holiday shipping season, Rogers explained. The lower recent growth numbers could indicate that inventory growth is slowing, "which could indicate lower sales expectations than previous years," the researchers said.

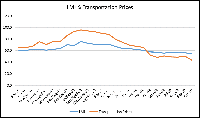

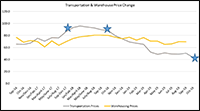

In addition, transportation prices contracted and hit their lowest level in the history of the index, falling more than 7% to 43.5. That score is half the rate reported a year ago and corresponds with an increase in transportation capacity.

"It seems the transportation market is having problems," Rogers said, pointing to a year-long slide in prices. "The market is getting soft."

Looking ahead, the future expectations for transportation prices are also down—nearly 6% to a reading of 62.7 from 68.1—indicating expectations of price increases over the next 12 months, according to the report.

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing