Developers experiment with multistory DCs as tight warehouse market drives high rents, CBRE says

A combination of soaring e-commerce demand and rising real estate prices in the country's densest

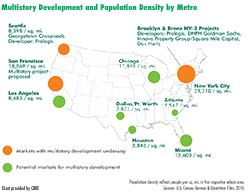

This CBRE chart shows current and potential areas for multistory warehouse development and the population density of each area.

This CBRE chart shows current and potential areas for multistory warehouse development and the population density of each area.markets is inspiring developers to build a new wave of multistory warehouses, a report released today by real estate services and investment firm CBRE Group Inc. said.

Distribution centers (DCs) with multiple stories are typically restricted to European and Asian markets, where industrial space is at a premium compared to sprawling U.S. cities. That rule of thumb still holds true, but a perfect storm of market conditions in the U.S. might make it possible for the phenomenon to reach this country as well in certain geographies, the firm found.

CBRE is tracking the development of five multistory warehouses currently under construction, including three in New York City, one in San Francisco, and one recently completed in Seattle. The common threads in those projects are: a large, densely packed population; high industrial land prices and rents; and significant penetration of e-commerce use among residents, according to CBRE.

One of the most important drivers of favorable conditions for multistory warehouses is land prices for industrial development, which have more than doubled in the U.S. over the past five years to roughly $30 per buildable square foot—comparable to office rents—CBRE found.

By another measure, CBRE reported today in a separate release that demand for warehouses, DCs, and other industrial property continues to outpace supply. The availability rate for U.S. industrial real estate declined by 11 basis points in the third quarter of 2018, marking its 33nd consecutive quarterly decline, CBRE said.

The availability of U.S. industrial real estate dipped to 7.1 percent in the third quarter, the lowest point since 2000, as demand for warehouses and DCs remains driven by the growth of e-commerce and the general strength of the U.S. economy, the firm said. CBRE defines availability as the sum of vacant space plus space that is currently occupied but otherwise being marketed for use by new tenants.

"In this economic cycle, large operators are focused on speed to market and being as close as possible to consumers. So if you can find a site that's a short drive into the city, you can accommodate rapidly changing consumer demands for next-day or even same-day delivery," Matthew Walaszek, a Senior Research Analyst at CBRE, said in an interview. "But if you can't build out, one potentially viable option is to build up" with multistory DCs, he said.

One test case that CBRE is tracking to measure the trend is a multistory warehouse development in Seattle that was recently completed by industrial property developer Prologis. Known as Georgetown Crossroads, the three-floor, 590,000-square-foot industrial warehouse sited minutes from downtown Seattle features truck ramps leading to loading docks on the second level and a third floor that is served via forklift-accessible freight elevators, for lighter-scale warehouse operations.Take a virtual reality tour of the site at this link.

"Multistory development [in the U.S.] is starting to take shape, but it is not taking off," Walaszek said. "It's a trend we're starting to see, but we've got some time before it can compare to Asian development" in cities like Hong Kong or Singapore, he said.

That's because developers would have to wait too long to get a payback on their investment in all but the densest U.S. markets, such as New York, San Francisco, or Los Angeles. In comparison, land prices and rents in cities such as Hong Kong, Tokyo, and London remain two to three times more expensive than in most U.S. cities, CBRE says.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing